Recognizing when to change your deductible and also when to search for a new cars and truck insurance provider with budget friendly prices is the best way to prevent high expenses in the future. Our Recommendations For Automobile Insurance Searching for vehicle insurance policy doesn't need to be difficult. Just see to it to obtain quotes from multiple suppliers, so you can contrast prices.

trucks auto insurance cheaper auto insurance dui

trucks auto insurance cheaper auto insurance dui

What is a deductible? An insurance deductible is the amount you pay of pocket toward repairs for your automobile as a result of a covered loss. If you have a $500 deductible and also you're in a crash that results in $3,000 of fixings to your vehicle, you pay only $500 towards fixings. cheapest car insurance.

In most markets, when you're not liable for an accident, we can waive the insurance deductible if we can recognize the various other event, that they're at fault, and their insurance coverage service provider verifies they have legitimate obligation insurance coverage for the accident - low cost. This examination can require time, so the insurance deductible may apply at the beginning of the case as well as be compensated later on.

Your insurance deductible only applies when your insurer spends for your vehicle repair services. There is no deductible if the other party's insurance coverage is dealing with the fixings. The deductible only uses to your own car fixings. There is no insurance deductible for the other celebration's lorry repairs under your plan. Your cases solution representative will send you a compensation check for your insurance deductible.

Some Ideas on What Is An Insurance Deductible? - Allstate You Should Know

For the responsibility portion of your automobile insurance plan, which covers the prices to fix any kind of damages to an additional motorist's vehicle, there is no deductible on your cars and truck insurance policy when you're at mistake in an accident. Nearly all states need drivers to bring obligation insurance coverage.

Various other states with large cost savings were (14 percent), (13 percent), (13 percent) as well as (12 percent). auto insurance. The national average conserving on costs was 15 percent.

Consider each deductible individually, and think about setting various deductibles for your automobile insurance policy detailed insurance deductible as well as your collision insurance deductible. For instance, you may take a look at reducing your comprehensive deductible considering that it represents a smaller part of the total premium. That means you will not conserve much cash if you raise this insurance deductible.

insurers insurance companies cheaper vehicle

insurers insurance companies cheaper vehicle

Despite the fact that your insurance deductible does not reset each year, you would certainly still require to pay a deductible every time you make an insurance claim. Some insurance firms will certainly reduce your insurance deductible for every year you do not have a crash (insurance). What you might not see is that these "financial savings" are pumping up the cost of your costs - accident.

All About How Health Insurance Works - Blue Cross Blue Shield Of ...

If it only takes a couple of months or a year, you can reserve sufficient to pay your costs, and also then start banking the remainder. Paying an insurance deductible can suggest needing to cough up a significant chunk of modification. If you're worried that you can't afford ahead up with adequate money to pay your insurance deductible, you have a couple of options.

When you're attempting to identify just how much your deductible ought to be for vehicle insurance policy, ask your insurance provider concerning what their process is for collecting deductibles, and how lengthy it may take for you to get a payout. Below's what you can normally expect in a couple of various situations. Initially, your insurance provider must accept the claim in order for you to receive a payment.

When the amount of your problems reaches your deductible, the insurer will certainly provide a payout for any type of fixing prices beyond that amount When you enter into a crash with one more vehicle, the insurance provider entailed will certainly carry out an investigation into which chauffeur was at fault to determine who pays the vehicle insurance policy deductible (perks).

What is an insurance coverage deductible? An insurance policy deductible is the amount of money you have to pay from your very own pocket before your insurance protection kicks in.

The What Is A Deductible In Business Insurance? - Insureon Ideas

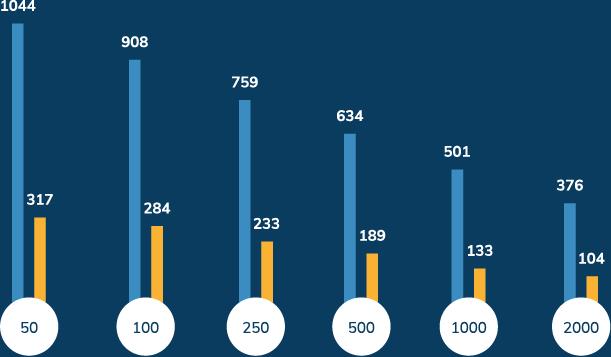

Raising it from $500 to $1,000 could produce a 14 percent cost savings. Once again, these are simply estimates. When it pertains to residence insurance coverage, savings can likewise be significant. This New York Times item reports that elevating a Massachusetts residence insurance policy deductible from $500 to $2,000 might conserve as long as 20 percent or more.

As well as if you do not need to sue for 2, three, or 4 years you could save a considerable amount of money over time (insured car). (FYI: the ordinary vehicle owner drives for 8. 3 years without sending a case. SUV and pickup vehicle proprietors have cases roughly every 6. 5 years) - insurers.

Exist other ways to save money on insurance? Yes! We've noted some of one of the most typical insurance coverage discounts right here. Various other alternatives consist of added safety and security measures or residence updates like a security system, an emergency situation generator, a new roof covering, brand-new electric or plumbing systems. As always, we like to remind people that insurance coverage is a very customized subject. trucks.

You'll likewise have to pick your insurance policy deductible, which can be a lot more challenging than it sounds. To choose the best insurance deductible for you, you'll need to consider your driving background, your emergency fund, as well as the prices of different deductibles, along with several other elements.

The 8-Minute Rule for What Is A Deductible? - Sonnet Insurance

car insured dui car insurance auto insurance

car insured dui car insurance auto insurance

Trick Takeaways Your deductible is the section of costs you'll spend for a protected claim. Evaluate your vehicle's worth, your emergency fund, and also the prices of protection when picking a deductible. Picking a greater deductible may help you conserve cash on premiums, however this indicates you'll have to pay more out of pocket after a mishap.

In some states, you might likewise have a deductible for:: Pays to fix your cars and truck after damages triggered by a motorist without insurance or without enough coverage.: Pays your clinical expenses when you have actually been injured in an accident.: Covers the costs of some mechanical repair services, similar to a service warranty.

Whether you pay a deductible after an event relies on your insurance coverage, that is at fault, your insurance coverage firm, and your state's regulations (cheapest car). For instance, in California, you could certify for an insurance deductible waiver on your crash coverage, which implies your insurer will certainly pay the deductible if an uninsured motorist strikes you.

How Does a Deductible Work? Think of a tree branch drops on your vehicle as well as triggers damage. You sue on your thorough insurance coverage and also the fixing shop estimates it will certainly cost $1,000 to deal with - cheaper cars. What you'll pay relies on your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the expense of fixing the damage is the exact same or nearly the same as your insurance deductible, you may pick not to submit a case given that you 'd lose any claim-free discount rate.

See This Report about Should I Have A $500 Or $1000 Auto Insurance Deductible?

When Do You Pay a Deductible? You'll generally pay your deductible straight to the car service center after they finish the repair services. The insurance firm will certainly subtract your part from the total amount they send out to the service center. In the circumstance above, with a $500 insurance deductible, the insurance coverage company would certainly pay the car repair work shop $500, as well as you 'd be anticipated to pay the other $500. auto.

As the vehicle's value comes down, the opportunity of an overall loss goes upmeaning it may not be worth getting optional insurance coverages. The Kansas Insurance coverage Division advises carrying just liability insurance coverage on autos worth less than $3,000.

Various Other Inquiries to Ask When Picking Deductibles While the three variables above are the most essential when picking an insurance deductible, you'll want to ask these inquiries, as well. Many coverage deductibles begin at $250 or $500, yet some insurance providers offer a $0 insurance deductible alternative for particular coverages, and others may call for higher-risk vehicle drivers to carry greater deductibles.

Can You Make Use Of Various Other Insurance Coverage to Cover the Prices of Injuries? In some states, you may be able to make use of wellness insurance coverage to pay the expenses of injuries due to automobile accidents rather than relying upon automobile insurance coverage, such as medical payments or PIP insurance coverage. In this instance, you might select a higher deductible or a reduced limit on those protections, which would certainly save you cash.

Some Known Factual Statements About What Is A Car Insurance Deductible? - Promutuel Assurance

If your cars and truck is currently at the service center, you might take out a finance to pay the insurance deductible or ask the store to hold your vehicle till you can discover some additional money. cheaper car. What Is the Highest Possible Deductible for Automobile Insurance? The highest possible insurance deductible readily available to you depends upon your state as well as your insurer, however Mc, New bride claimed an ordinary high deductible is around $1,000.

auto cheaper auto insurance low-cost auto insurance insurance affordable

auto cheaper auto insurance low-cost auto insurance insurance affordable

For specialty https://smart-trick-car-insurance-for-teens-and-new-drivers.s3-web.sng01.cloud-object-storage.appdomain.cloud/ automobiles or collectibles, they can get to $5,000 to $10,000. What Is the Typical Deductible for Automobile Insurance? No national average throughout states and insurers has been released, however Progressive says $500 is the most common insurance deductible picked by its insurance policy holders (low-cost auto insurance).