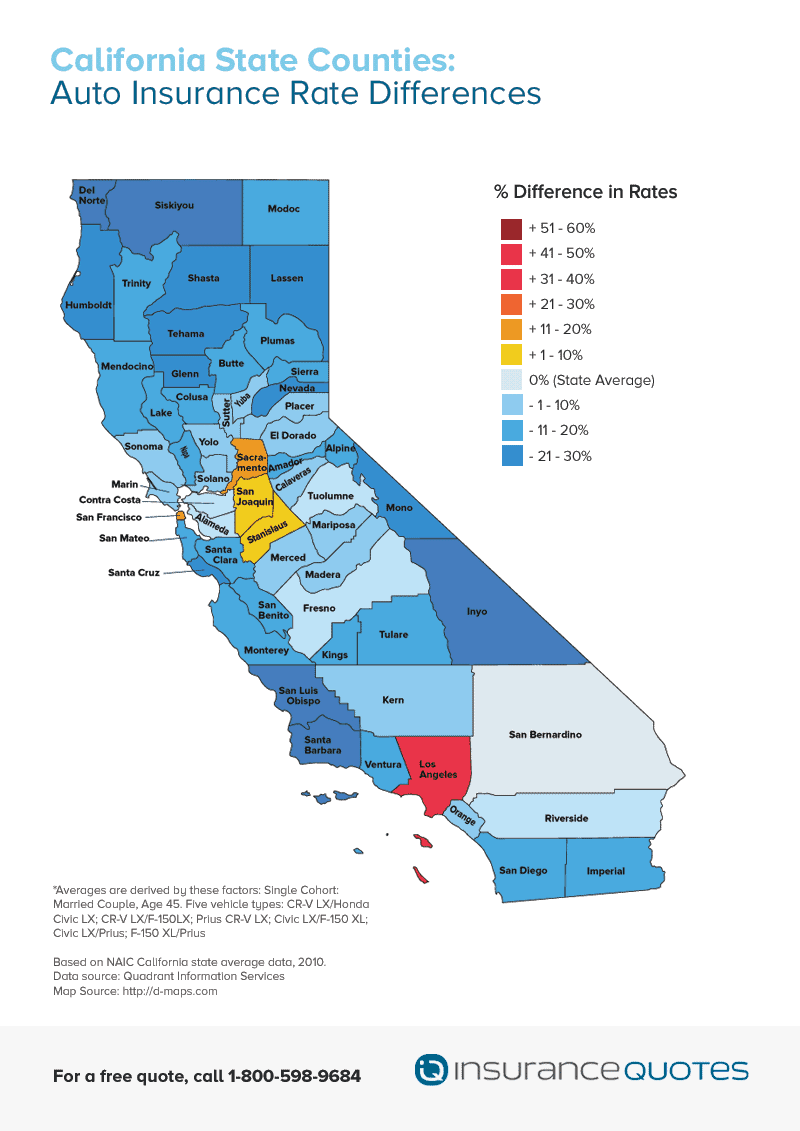

San Franciso chauffeurs pay a standard of $233. Vehicle drivers in Los Angeles are actually clearing those pocketbooks: their ordinary price of automobile insurance is a monstrous $274! The area you live in is one of the significant variables that cars and truck insurance providers make use of to identify how much you pay on your month-to-month premium.

Compare Car Insurance Coverage Rates Currently you recognize that various aspects help identify just how much you pay for cars and truck insurance policy. Among the most reputable means to decrease your auto insurance policy premium is to compare different insurance coverage providers, which is something we focus on at Cost-U-Less Insurance policy. cheapest. If you pay for your insurance coverage one month at once, you can commonly exchange insurance coverage carriers whenever you intend to.

perks low cost auto cheapest car insurance insurers

perks low cost auto cheapest car insurance insurers

The average price of a full insurance coverage policy in California is $1,857 each year. Nonetheless, insurance policy prices in California can differ considerably from one city or postal code to one more. Even though rates are high, you can still locate inexpensive vehicle insurance policy in California by contrasting quotes from numerous business.

The table listed below shows the 5 least expensive car insurance provider in The golden state, together with their J.D. Power score. Most affordable cars and truck insurance policy companies by age in The golden state, Youthful adults usually have very high insurance coverage prices due to the fact that their lack of experience behind the wheel indicates they are more probable than older chauffeurs to be in an accident. car insurance.

In several states, various insurance provider have the most affordable prices for different age teams based on their internal ranking systems - cheaper cars. The golden state, nevertheless, Get more info has one firm that ranks less than the competition in each and every single age. Choosing the ideal cars and truck insurer in California, Picking the ideal automobile insurance policy company for you does not have to be difficult.

Automobile insurance rates for motorists with driving violations in California, Your driving background is one of the variables insurance business utilize to assist establish your rates, which indicates a mishap or a traffic ticket might have a substantial effect on just how much you pay for insurance. Maintaining your driving document tidy is the most convenient and also most effective way to maintain your insurance coverage costs low - car insured.

The Best Strategy To Use For Business, Home & Car Insurance Quotes - The Hartford ...

Cheapest car insurance for chauffeurs with bad credit rating in The golden state, Insurance companies in some states price chauffeurs based upon their credit report. In theory, this is due to the fact that chauffeurs with reduced credit report are much more most likely to submit an insurance claim as opposed to paying for damages out-of-pocket, yet in method it in some cases winds up unfairly penalizing some motorists.

In order to offer low-cost responsibility insurance, The golden state minimum insurance coverage demands are really low (low cost). This implies they might not offer sufficient security if you are at fault for a crash that is much more than a basic fender bender. The state also does not require you to bring anything even more than standard physical injury and also property damage obligation coverage, which means motorists carrying state minimum coverage levels don't have insurance coverage for damages to their very own automobile as well as they have no security versus uninsured or underinsured motorists.

cheapest cars affordable auto insurance cheapest auto insurance

cheapest cars affordable auto insurance cheapest auto insurance

Regularly asked inquiries, Exactly how much is auto insurance policy per month in California? Chauffeurs in California pay an average of $1,857 per year for cars and truck insurance coverage, which breaks down to $154.

affordable auto insurance cheap automobile dui

affordable auto insurance cheap automobile dui

Is The golden state a mistake or no fault state? California is an at-fault state, which indicates a driver that is at mistake in a crash is in charge of the bodily injury as well as residential or commercial property damages expenses brought on by the accident, whether or not they have adequate auto insurance policy to cover those costs.

Rates for driving violations and "Poor" credit score identified using ordinary prices for a single man 30-year-old vehicle driver with a credit score under 578. Some service providers may be stood for by affiliates or subsidiaries. Fees provided are an example of costs. Your actual quotes may vary.

.jpeg) affordable car insurance dui business insurance cheap car

affordable car insurance dui business insurance cheap car

Exactly How Much Does Cars And Truck Insurance Policy Cost in The Golden State? It additionally has some of the greatest typical rates in the country when it comes to auto liability insurance coverage.

The Only Guide for Average Car Insurance Costs In 2021 - Ramseysolutions.com

While auto insurance has a greater typical cost in The golden state than in numerous various other states, it's still feasible to locate good protection options for your car - cheaper cars. This guide to the most effective cars and truck insurance coverage deals can aid you find an inexpensive means to protect your vehicle - laws. Progressive $1,296 Geico $1,347 USAA $1,463 Mercury Insurance Policy $1,470 Allstate $1.

If that exact same motorist, nevertheless, owns an automobile or has normal accessibility to an auto, he would need to submit a non-owners SR22 certification. This gives the chauffeur coverage whenever he is given authorization to drive an auto not his own (cheap). The cost of an SR22 ranges insurance provider.

Insurance provider that do provide SR22 protection often tend to do so at a high cost. The certification itself is not the only cost. SR22 insurance clients likewise undoubtedly pay higher costs for their minimum obligation protection. This is because of the truth that they are currently thought about risky vehicle drivers. money. Some insurance policy business even require risky chauffeurs to spend for the entire coverage duration at once - insured car.

When initially ordered to acquire an SR22, a person will likely first call their present car insurance provider (auto insurance). As soon as that takes place, it, unfortunately, informs the supplier to the fact that a considerable event has occurred. insurance. The insurance provider will certainly continue to access the DMV document to examine why the motorist needs the certificate.

If the policy is terminated, the vehicle driver will certainly be compelled to locate an alternate alternative. If the certificate is provided, the premium prices will certainly a lot more than most likely rise. A driver is not needed to acquire an SR22 from their current vehicle insurance coverage business. He is allowed to search for the very best option. cheap.

Generally, a driver is required to have an SR22 on documents for three years after a license suspension due to DUI. vans. The original certificate will continue to be on documents with the DMV as long as either the vehicle insurance policy company or the driver does not cancel the plan. There is no requirement to re-file yearly.

Examine This Report about Faq - California Low Cost Auto Insurance

After facing arrest, court days, as well as irritating needs from the DMV, the last point they wish to do is haggle with an insurance policy agent. Fortunately is that there are choices. Agencies are around that can help you discover the very best rates for SR22 insurance policy. Take A Breath Easy Insurance Coverage is the SR22 Leader in California.

In almost every state, a minimum of some quantity of cars and truck insurance coverage is called for by legislation to obtain behind the wheel. Being lawfully called for, vehicle insurance is vital to maintain you protected from the monetary concern of a range of bad things that can occur in, around, as well as to your car.